OKToken — built for long-term performance with a risk-managed model

OKToken saves you from:

-

Investment Uncertainty

Fluctuating asset values cause significant stress.

-

Unstable Returns

Sharp declines in value can seriously undermine investor’s financial standing.

-

Limited Access to Information

Lack of transparency restricts the ability to make informed investment decisions.

-

Lack of Transparency

Investors are at risk of falling victim to fraudulent schemes.

About OKToken

Benefits for your investments

-

Stable growth

Our unique mechanism, including dynamic supply management and pegging to a stable currency, ensures sustainable growth of your investment.

-

Transparent operations

All transactions are fully transparent and available for your review, ensuring complete trust in the platform’s processes.

-

Minimal risks

Through strategic reserves and limited issuance, we minimize the risks typically associated with cryptocurrency investments.

OKToken growth mechanism

OKToken maintains its value through:

Automated transaction

Every OKToken trade includes an 11% protocol fee: 10% moves into a permanently locked reserve that reinforces on-chain liquidity, while 1% supports continuous product development. By feeding the reserve that powers the price formula, each contribution sustains a risk-managed framework designed for long-term performance.

Dynamic supply management

The OKVault smart contract automatically adjusts the number of tokens in circulation. When demand for the token increases, OKVault releases additional tokens. Conversely, when demand decreases, the contract burns some tokens to reduce their quantity and support the value.

Pegging to a stable currency

After every transaction, OKVault recalculates price as USDT reserve ÷ circulating supply, effectively tethering OKToken to a widely used stable asset. This dynamic reference point helps dampen day-to-day swings and provides transparent, on-chain visibility into valuation.

Roadmap

Affiliate Program

-

Step 1

Connect your wallet to activate your personal account on OKToken.

-

Step 2

Click the icon in the top-right corner of your account to access the affiliate program page.

-

Step 3

Copy your personal invite link and share it with friends. You’ll earn 20% of the project’s revenue generated through their activity — directly to your wallet.

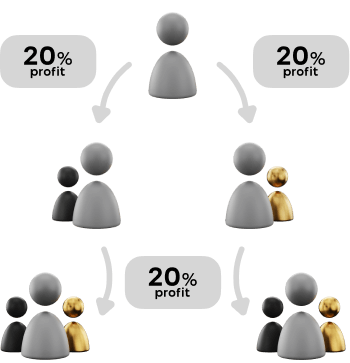

Affiliate structure with tiers

-

Level 1

20% of the project’s revenue.

-

Level 2

20% of the revenue generated by the Level 1 partner you referred.

-

Level 3

20% of the revenue generated by the Level 2 partner you referred.

Media about us

F.A.Q.

-

What is OKToken?

OKToken is an ERC-20 digital asset on Ethereum, purpose-built for long-term performance. Its on-chain pricing formula divides the USDT reserve by the circulating supply, so every recalculation either keeps the quoted price where it was or nudges it higher—never lower. All movements are fully transparent and visible on the blockchain. -

How does OKToken work?

Two autonomous contracts shape the ecosystem:

- OKToken — the transferable ERC-20 token.

- OKVault — a controller that mints, burns, and recalculates price.

After each transaction, OKVault updates the price by applying the formula USDT reserve ÷ circulating supply. The mechanism runs entirely on-chain and needs no external market-makers.

-

Key attributes

- Risk-managed model: A 10% reserve contribution on every purchase expands the liquidity pool and raises the arithmetic price floor over time.

- On-chain transparency: Balances, fees, and price updates are verifiable in real time—anyone can audit the data.

- Smart-contract execution: You buy or sell directly from your wallet; the contract settles instantly. When any individual position reaches a 20% net gain (≈ 50% gross), the system can close it for you automatically, eliminating the need to babysit orders.

- Decentralized roadmap: Governance, staking, and credit features will roll out through community voting rather than centralized decrees.

-

How can my holdings evolve over time?

Every purchase routes 10% of the trade value into an immutable reserve. Because the price formula references that reserve, each buy lifts the on-chain price floor. Selling burns tokens and applies the same fee, so the reserve stays proportionate to the remaining supply. The design softens sharp market moves and aligns growth with overall network activity. -

Fee structure & performance pathway

- Protocol contribution: 11% on every buy or sell (10% to the reserve, 1% to ongoing development).

- Round-trip friction: Selling immediately after buying—before any appreciation—would return roughly 79.21% of the starting USDT due to the two fees (≈ 20.79% impact).

- Alignment of incentives: The same fee that funds development and liquidity also encourages a longer-term horizon, as price recalculations gradually lift the floor.

-

How do I start using OKToken?

-

Where can I track the current value of OKToken?

The current value of OKToken can be tracked through our platform interface, where real-time data on the token’s exchange rate is available. -

How is the security of my investments ensured?

The security of OKToken is ensured through the use of verified smart contracts, as well as through complete decentralization and automation of processes. Our contracts undergo regular audits to ensure their reliability and safety.